20+ Years in the Financial Industry

500+ Clients helped through Tax Strategy

100+ Entrepreneur guided from Idea to Profitability

Licensed Mortgage Broker and Enrolled Agent

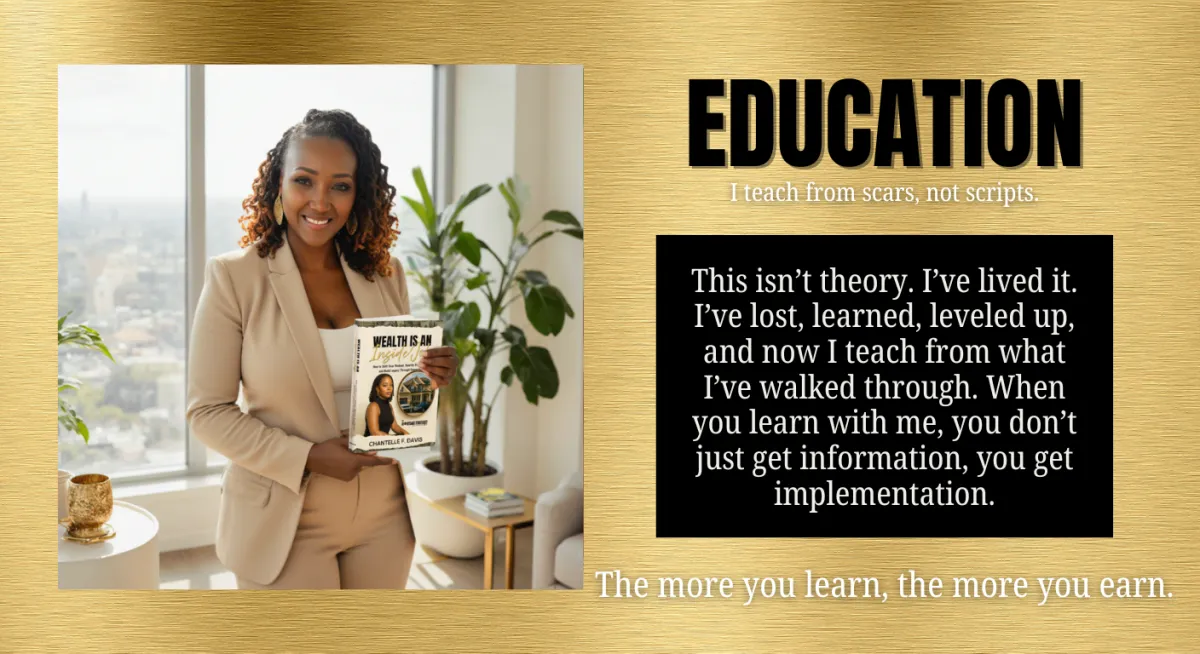

THE VALUES BEHIND THE BRAND

I don’t just teach ownership... I live it.

These 6 values shape how I serve every client:

Authenticity. Empowerment. Education. Faith. Legacy. Integrity.

WORK WITH CHANTELLE

Elevate your strategy. Build your wealth. Get unstuck... for real.

Fix Your Credit.

Fund Your Future.

A free guide for women with damaged credit who are ready to rebuild, reposition, and reclaim their financial power.

What's Inside:

How to break down your credit profile like a lender

The top 3 mistakes keeping your score stuck

Steps to boost your score and position for funding

Want a personalized credit strategy?

Meet The Strategist.

The Real Chantelle: Strategy Over Struggle. Always.

I didn’t grow up around wealth. In my house, money was grown folk business. You didn’t ask. You didn’t talk about it. You just hoped there was enough.

It wasn’t until college that I realized — we weren’t middle class. We were surviving. My mom did what she could. Before every semester, we’d hit Sam’s Club. She’d load me up on food and supplies.

I had so much, I started selling ramen noodles. Because even then, I didn’t like it. But hustle? Hustle, I understood.

What I didn’t understand...

was strategy.

Then came credit.

On-campus credit card offers were everywhere. And like a lot of us, I took them. Used them. Maxed them. Ignored the bills.

And when the debt started stacking, I shrugged: "Put it on my credit, I don’t care."

Because I didn’t know better.

Even after I had kids. Even after I started making money. I still moved like someone who was broke.

No savings.

No plan.

No clue how credit could work for me.

Then came the night that changed me.

Coming home from a Little League game in Miami, I accidentally took the turnpike. Pulled up to the booth.

“50 cents.”

I didn’t have it.

Not two quarters. Not 5 dimes,

Not 10 nickels. Not 50 pennies.

Nothing.

That wasn’t just a toll booth.

That was a wake-up call.

But my real turning point came years later. 2018. My son was going to college. I had to choose:

Pay for school?

Or my car note?

I chose him. My car got repossessed. While I was on the phone trying to get it back, I saw the numbers. I’d paid thousands. And my loan barely moved. The interest rate? 28%. My score had started with a 4. But I felt proud because I didn’t need a cosigner.

That was the problem.

That’s when I got serious. Not just about money - about strategy.

I stopped hustling backwards.

I rebuilt. I learned the system.

I lived the blueprint. And I stopped teaching from theory. I started teaching from truth.

What I Do Now

I help underestimated entrepreneurs:

Use credit as a wealth tool

Reduce tax liabilities through strategy

Build legacy even if they're the first in their family to try

Because I’ve been the girl who couldn’t pay 50 cents.

And now?

I’m the woman who teaches you how to build wealth through ownership.

Real Talk. Real Tools. Real Results.

The Truth About Multiple Income Streams: It’s Not What You Think Post

You Don’t Need 7 Jobs to Get Rich

Somewhere along the way, social media made us believe that wealth requires doing the most working a 9 to 5, running a side hustle, flipping real estate, day trading, and maybe even making candles on the side.

Let’s be clear:

Wealthy people don’t juggle seven jobs.

They build seven streams of income most of which don’t require them to clock in every day.

If you’re feeling like you’re constantly chasing money but never catching up, it might be time to stop hustling and start strategizing.

Let’s start with the foundation of it all:

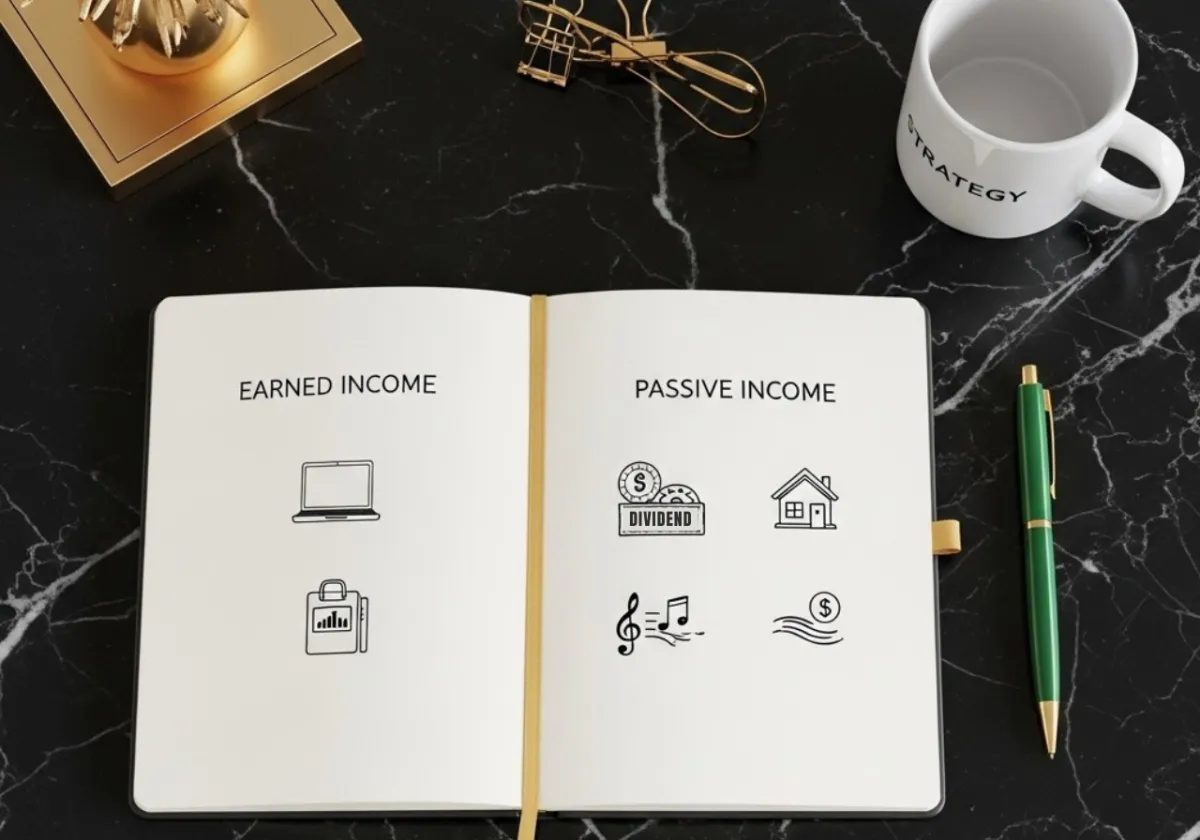

Earned vs. Passive Income.

What Is Earned Income?

Earned income is exactly what it sounds like: money you earn by working for it.

You’re trading your time, energy, and skills for a paycheck.

💼 Examples of Earned Income:

Your full-time job or salary

Freelance work or consulting gigs

Uber, DoorDash, or other side hustles

Commissions from real estate or insurance

Service-based businesses like hair, taxes, or coaching

Earned income is usually the first stream people build because it’s the easiest to understand. You do the work, you get the money.

But here’s the problem:

If you stop working, the money stops flowing.

That’s why we need to talk about its wealthier cousin…

What Is Passive Income?

Passive income is money that continues to come in even when you’re not actively working for it.

It usually starts with a strategy, an asset, or a system not hustle.

🧠 Examples of Passive Income:

Rental income from real estate

Dividends from stocks or investments

Royalties from a book, course, or song

Digital product sales (eBooks, templates, memberships)

Affiliate marketing (getting paid for recommending products)

Business income where your team or systems do the work

Passive income might take some time to build, but once it’s flowing, it works even when you don’t.

“It’s not about doing more... it’s about earning smarter.”

Earned vs. Passive: Side-by-Side

Earned IncomePassive IncomeRequires active time + effortGenerates income with minimal effortStops when you stop workingKeeps going even if you take a breakOften tied to a job or serviceTied to ownership, assets, or automationYou work in itYou build it and step out of it

You’re Closer Than You Think

You might already have earned income flowing—but don’t stop there.

Ask yourself:

Can I turn my service into a product?

Can I monetize my expertise in a digital course?

Can I invest a portion of my earned income into something that pays me back?

It doesn’t take seven jobs to change your life.

It takes one income stream you build right.

Shift the Goal: From Hustle to Ownership

Here’s what wealthy people know:

You can’t hustle your way to freedom.

You have to own something.

Whether it’s a rental, a business, a book, or an online offer—ownership is the foundation of wealth. That’s how you shift from surviving to scaling. From working harder to earning smarter.

“Wealthy people don’t work 7 jobs they build 7 streams that work for them.”

🛠️ Action Step:

Grab a sheet of paper.

Write down every way you currently earn money.

Now put an “E” next to the earned ones, and a “P” next to the passive ones.

👉 Choose one earned stream you can begin converting into a passive one.

That’s where your wealth journey begins.

Ready to Build Real Wealth?

Let’s get clear on your income blueprint—so you can stop trading time and start building legacy.

📩 Email me at [email protected] or call/text (561) 867-8329 to build a strategy that works for you, not on you.