20+ Years in the Financial Industry

500+ Clients helped through Tax Strategy

100+ Entrepreneur guided from Idea to Profitability

Licensed Mortgage Broker and Enrolled Agent

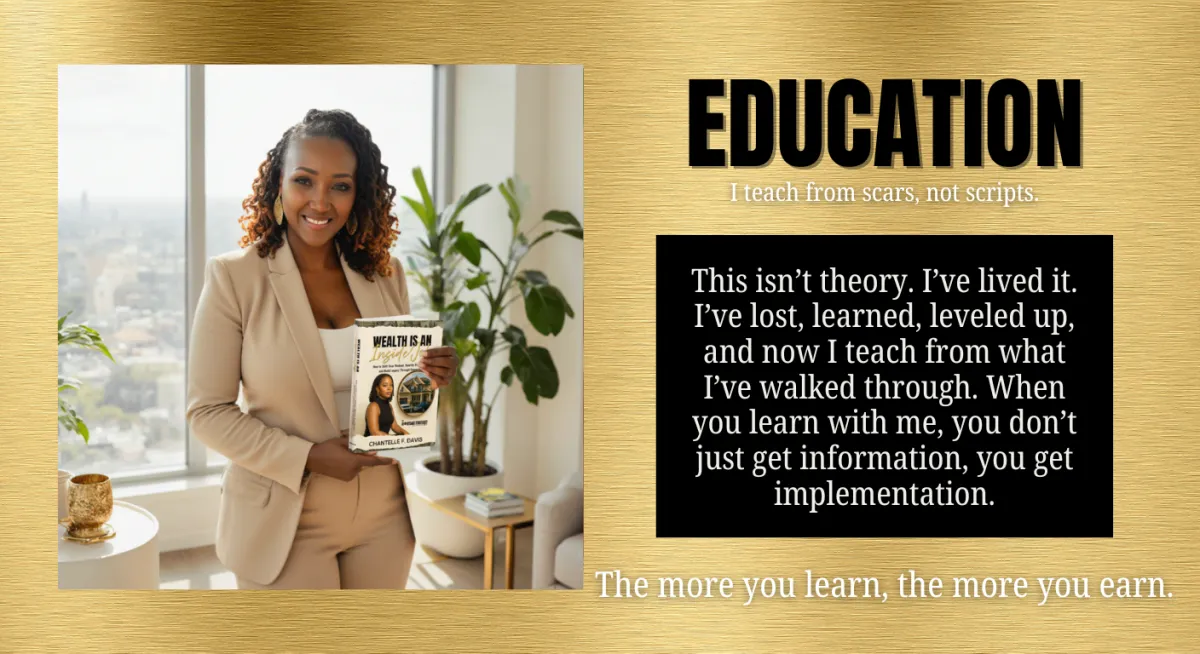

THE VALUES BEHIND THE BRAND

I don’t just teach ownership... I live it.

These 6 values shape how I serve every client:

Authenticity. Empowerment. Education. Faith. Legacy. Integrity.

WORK WITH CHANTELLE

Elevate your strategy. Build your wealth. Get unstuck... for real.

Fix Your Credit.

Fund Your Future.

A free guide for women with damaged credit who are ready to rebuild, reposition, and reclaim their financial power.

What's Inside:

How to break down your credit profile like a lender

The top 3 mistakes keeping your score stuck

Steps to boost your score and position for funding

Want a personalized credit strategy?

Meet The Strategist.

The Real Chantelle: Strategy Over Struggle. Always.

I didn’t grow up around wealth. In my house, money was grown folk business. You didn’t ask. You didn’t talk about it. You just hoped there was enough.

It wasn’t until college that I realized — we weren’t middle class. We were surviving. My mom did what she could. Before every semester, we’d hit Sam’s Club. She’d load me up on food and supplies.

I had so much, I started selling ramen noodles. Because even then, I didn’t like it. But hustle? Hustle, I understood.

What I didn’t understand...

was strategy.

Then came credit.

On-campus credit card offers were everywhere. And like a lot of us, I took them. Used them. Maxed them. Ignored the bills.

And when the debt started stacking, I shrugged: "Put it on my credit, I don’t care."

Because I didn’t know better.

Even after I had kids. Even after I started making money. I still moved like someone who was broke.

No savings.

No plan.

No clue how credit could work for me.

Then came the night that changed me.

Coming home from a Little League game in Miami, I accidentally took the turnpike. Pulled up to the booth.

“50 cents.”

I didn’t have it.

Not two quarters. Not 5 dimes,

Not 10 nickels. Not 50 pennies.

Nothing.

That wasn’t just a toll booth.

That was a wake-up call.

But my real turning point came years later. 2018. My son was going to college. I had to choose:

Pay for school?

Or my car note?

I chose him. My car got repossessed. While I was on the phone trying to get it back, I saw the numbers. I’d paid thousands. And my loan barely moved. The interest rate? 28%. My score had started with a 4. But I felt proud because I didn’t need a cosigner.

That was the problem.

That’s when I got serious. Not just about money - about strategy.

I stopped hustling backwards.

I rebuilt. I learned the system.

I lived the blueprint. And I stopped teaching from theory. I started teaching from truth.

What I Do Now

I help underestimated entrepreneurs:

Use credit as a wealth tool

Reduce tax liabilities through strategy

Build legacy even if they're the first in their family to try

Because I’ve been the girl who couldn’t pay 50 cents.

And now?

I’m the woman who teaches you how to build wealth through ownership.

Real Talk. Real Tools. Real Results.

7 Steps to Revitalize Your Credit and Build Wealth Through Ownership

Let’s be clear: perfect credit is not the goal ownership is.

But if you’re stuck, overwhelmed, or don’t know where to start with your credit, this post is for you.

I created this 7-step Credit Revitalization Game Plan to help everyday people take back control of their credit and start building the kind of wealth that doesn’t just flex it frees. Whether your goal is to buy a home, start a business, or stop being denied for things you deserve, this is your starting line.

Why Credit Revitalization Matters

Your credit report is your financial resume. And if it’s full of errors, outdated info, or unaddressed damage, it can block you from opportunities that lead to ownership. That’s why we don’t just dispute, we strategize. We move with intention, not desperation.

Let’s walk through the 7 steps you can take right now to start revitalizing your credit.

Step 1: Pull All 3 Credit Reports

Before you fix it, you’ve got to face it.

Go to AnnualCreditReport.com and pull your reports from Experian, Equifax, and TransUnion. This is 100% free no credit card required.

✅ Pro Tip: Save them as PDFs and name them clearly (e.g., “Equifax_Aug2025”).

Step 2: Clean Up Your Personal Information

The personal information section on your credit reports matters more than you think. If you have multiple versions of your name, outdated addresses, or old employers listed, it can make it harder to dispute inaccurate accounts.

Highlight what’s wrong and prepare to submit a correction request. Accuracy here is key to your success later.

Step 3: Identify Negative Items Holding You Back

Go line by line. Look for:

Collections

Charge-offs

Late payments

Bankruptcies

Repossessions

Highlight anything you believe is inaccurate, outdated, or unverifiable. Make notes so you’re clear on what needs attention.

Step 4: Send Your First Round of Dispute Letters

This isn’t where you argue. It’s where you request an investigation under the Fair Credit Reporting Act (FCRA).

Use a Round 1 Investigation Request Letter that keeps the tone simple and consumer-based. You’re not denying the debt you’re asking for verification. This protects you and puts the burden of proof back where it belongs: on them.

Step 5: Track the 30-Day Timeline

Once the credit bureaus receive your letter, they have 30 days to investigate and respond. While you wait:

Pay down credit card balances

Avoid opening new accounts

Stay organized with a dispute tracker or calendar reminder

This is your time to prepare for what’s next.

Step 6: Review the Response and Follow Up if Needed

When you get your response, compare it across all 3 bureaus. If they “verified” something that’s still inconsistent or inaccurate, it’s time for Round 2.

You’ll want to send a Follow-Up Letter or a 30-Day No Response Letter if they ignored your request. This is where strategy beats frustration.

Step 7: Contact the Source Directly

Sometimes, the problem isn’t the bureau it’s the company reporting the account. If a debt collector, lender, or agency is reporting incorrect information, go straight to them.

Send a Debt Validation Letter requesting proof that the debt is valid, that they have the right to collect it, and that it’s being reported accurately.

📌 You have rights under both the FCRA and the FDCPA, use them.

Final Thoughts: This Is About Power, Not Perfection

Listen, I know what it feels like to avoid checking your credit, to feel ashamed of past mistakes, or to believe you’ll never recover.

But credit is a tool. When you learn how to use it, it can open doors you thought were shut.

You deserve ownership. You deserve strategy. And you deserve a fresh start.

Ready to Get Help With This Process?

Join my FREE Facebook group: Quietly Wealthy: Credit Edition Inside, we walk through this process step by step with live coaching, downloadable templates, and community support.

Or book a private credit consultation here: https://themortgagestrategist.net/bookappt

📌 Tweet This:

“Fixing your credit isn’t about perfection. It’s about power. Ownership is the end game.” – @chantelledavis