20+ Years in the Financial Industry

500+ Clients helped through Tax Strategy

100+ Entrepreneur guided from Idea to Profitability

Licensed Mortgage Broker and Enrolled Agent

THE VALUES BEHIND THE BRAND

I don’t just teach ownership... I live it.

These 6 values shape how I serve every client:

Authenticity. Empowerment. Education. Faith. Legacy. Integrity.

WORK WITH CHANTELLE

Elevate your strategy. Build your wealth. Get unstuck... for real.

Fix Your Credit.

Fund Your Future.

A free guide for women with damaged credit who are ready to rebuild, reposition, and reclaim their financial power.

What's Inside:

How to break down your credit profile like a lender

The top 3 mistakes keeping your score stuck

Steps to boost your score and position for funding

Want a personalized credit strategy?

Meet The Strategist.

The Real Chantelle: Strategy Over Struggle. Always.

I didn’t grow up around wealth. In my house, money was grown folk business. You didn’t ask. You didn’t talk about it. You just hoped there was enough.

It wasn’t until college that I realized — we weren’t middle class. We were surviving. My mom did what she could. Before every semester, we’d hit Sam’s Club. She’d load me up on food and supplies.

I had so much, I started selling ramen noodles. Because even then, I didn’t like it. But hustle? Hustle, I understood.

What I didn’t understand...

was strategy.

Then came credit.

On-campus credit card offers were everywhere. And like a lot of us, I took them. Used them. Maxed them. Ignored the bills.

And when the debt started stacking, I shrugged: "Put it on my credit, I don’t care."

Because I didn’t know better.

Even after I had kids. Even after I started making money. I still moved like someone who was broke.

No savings.

No plan.

No clue how credit could work for me.

Then came the night that changed me.

Coming home from a Little League game in Miami, I accidentally took the turnpike. Pulled up to the booth.

“50 cents.”

I didn’t have it.

Not two quarters. Not 5 dimes,

Not 10 nickels. Not 50 pennies.

Nothing.

That wasn’t just a toll booth.

That was a wake-up call.

But my real turning point came years later. 2018. My son was going to college. I had to choose:

Pay for school?

Or my car note?

I chose him. My car got repossessed. While I was on the phone trying to get it back, I saw the numbers. I’d paid thousands. And my loan barely moved. The interest rate? 28%. My score had started with a 4. But I felt proud because I didn’t need a cosigner.

That was the problem.

That’s when I got serious. Not just about money - about strategy.

I stopped hustling backwards.

I rebuilt. I learned the system.

I lived the blueprint. And I stopped teaching from theory. I started teaching from truth.

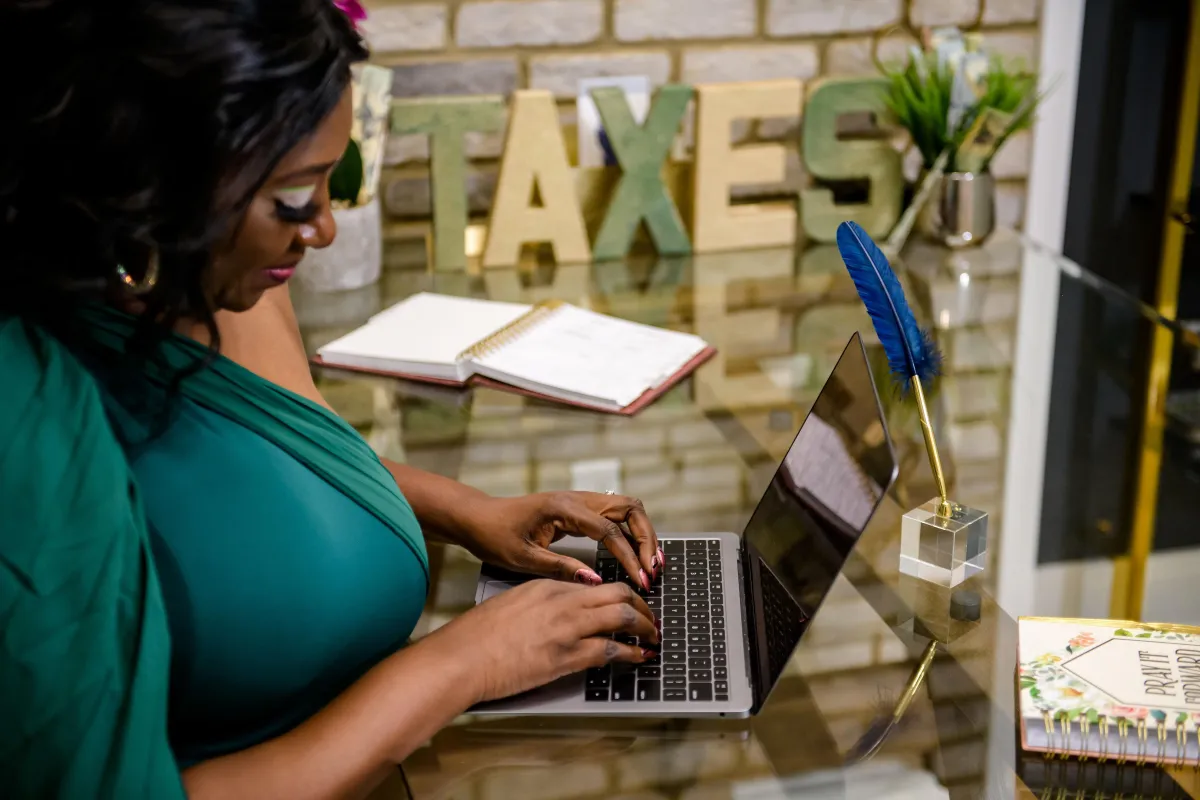

What I Do Now

I help underestimated entrepreneurs:

Use credit as a wealth tool

Reduce tax liabilities through strategy

Build legacy even if they're the first in their family to try

Because I’ve been the girl who couldn’t pay 50 cents.

And now?

I’m the woman who teaches you how to build wealth through ownership.

Real Talk. Real Tools. Real Results.

Why Fixing Your Credit Is the First Step to Building Wealth

Credit Isn’t Just a Score - It’s a Strategy

Let’s be clear. Your credit score isn’t just some number floating around in the universe. It’s a financial report card, a trust metric, and a gatekeeper all in one. In today’s system, it determines who gets access to what and at what cost.

Whether you’re applying for a mortgage, a car loan, a business line of credit, or even an apartment lease, your credit is being used to judge your character. Not your character as a person but your character as a borrower.

Credit isn’t just a number it’s your financial reputation. And reputation gets you access.

Why Lenders, Landlords, and Even Employers Check It

Your credit profile says a lot about how you’ve handled money in the past. Fair or not, lenders and landlords use it to decide if you’re “trustworthy” enough to lend to or rent to.

Employers in certain industries may even check your credit to gauge how you manage responsibility. Again, it’s not always about the money itself. It’s about how you manage it. And if they’re going to trust you with theirs.

The message is simple: if your credit is off, opportunities will be too.

How Credit Functions as a “Trust Metric” in Capitalism

In a capitalistic system, everything comes down to access and leverage. Your credit report helps determine whether you get access and whether you can leverage it at an affordable rate.

Think of your credit score like your personal interest rate thermostat. The better it is, the less money you’ll pay to borrow. The worse it is, the more your life costs and that cost adds up over time.

The Wealth Cost of Bad Credit

Let’s break it down:

Higher interest rates: You’ll pay thousands more in interest over the life of a loan.

Limited access: You might get denied for mortgages, business funding, or even phone plans.

Delayed dreams: Low scores delay wealth-building moves like buying a home or investing.

Emotional toll: Stress, avoidance, and embarrassment keep people stuck in silence.

Bad credit doesn’t mean you’re bad with money. It means it’s time to learn how the game is played and start playing to win.

Before You Build Wealth, Fix This First

You can’t talk ownership, leverage, or wealth-building without first repairing your foundation. Credit is the door. If it’s broken, locked, or boarded up your access is blocked.

This isn’t about shame. It’s about strategy.

Repairing your credit isn’t just about disputing collections or deleting negatives. It’s about understanding your score, building smart habits, and using credit to work for you instead of against you.

When your credit is in position, you can:

Qualify for better mortgage and loan options

Access funding to grow a business or invest

Get approved faster, easier, and with less stress

Save money over time

Own more, and owe less

Let’s Shift the Narrative and Start Where You Are

Fixing your credit isn’t just the first step. It’s the most powerful one. Because once you take control of your credit, everything else becomes possible.

This isn’t about having perfect credit. It’s about having positioned credit. And that starts today.

🔑 Action Tip:

Go to AnnualCreditReport.com and pull your free credit reports from all three bureaus. Don’t guess get the facts. Your report is your blueprint.

Listen, It’s time to stop sleeping on your credit.

If you’re serious about building wealth through ownership, it starts with your foundation. Let me help you fix it the right way no gimmicks, no fluff. Just real strategy.

Ready to get your credit in position?

Click here to start your credit repair journey with me

📩 Email me at: [email protected]

📞 Call or text: 561-867-8329

Let’s turn your credit around and turn your dreams into deeds.